Startups leverage venture capital through equity stakes, goodwill, convertible notes, or preference shares to raise necessary capital, minimizing financial burdens.

Prophet Funding

Prophet Funding

Prophet Funding

We make the funding available, offer someone to guide the awardees and help with their planning.

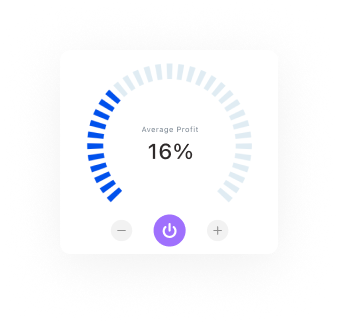

Prophet Funding is committed to creating high risk opportunities that deliver impressive high returns on investment.

Startups leverage venture capital through equity stakes, goodwill, convertible notes, or preference shares to raise necessary capital, minimizing financial burdens.

Terms such as equity, valuation, dilution, seed funding, and exit strategies like offering shares to the public and buyouts, among others.

Bootstrapping means seeking funds from venture capitalists to maintain equity stakes, hoping for big profits when the business generates profits.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum

While Venture capital is equity financing with high return and participation, loans are debt financing with interest on the amount borrowed.

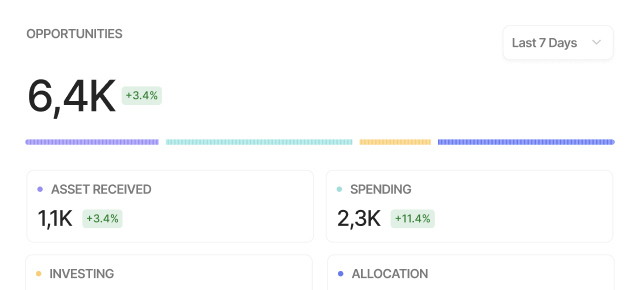

May assess market opportunity together with the team and the level of innovation.

Highlights the impressive potential for rapid growth, scalability, and highly profitable exit strategies.

It provides funding and guidance through the form of fostering invaluable business connections.

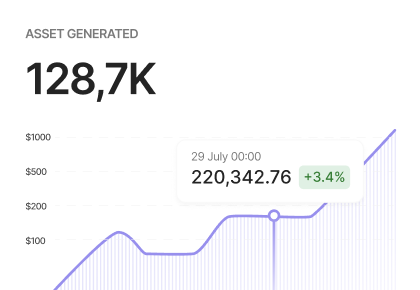

Venture capital serves as a crucial lifeline for companies striving for growth.

It regards funding, investment, and can also be associated with funding rounds and due diligence.

The different roles provide an opportunity to acquire equity and influence decision-making across various companies.

An exit strategy involves selling equity or starting an IPO to make a profitable return on investment.

It helped to develop our startup by providing new funds and valuable recommendations. Their support was a significant help to the ideas that were created.

With the help of Prophet Funding, we expanded very fast and reached specific goals. It was the turning point of their investment.

Behalf of Prophet Funding, we received the necessary funding and got professional advice to make our business grow and develop.